Blog Posts - 06.09.2025

The terms ESG (Environmental, Social, and Governance) and sustainability have become increasingly important in all sectors in recent years. The property industry in particular is a major source of environmental impact: 35% of global energy consumption, 50% of global resource consumption and a significant proportion of CO2 emissions are caused by this sector (source: Schäfer & Martel, 2021). The implementation of ESG criteria in property portfolios is therefore a key issue in order to achieve net zero emissions by 2050 and future-proof building portfolios.

Similar to the umbrella term Corporate Social Responsibility (CSR), ESG deals with corporate disclosures on environmental, social and ethical practices. Developed by the EU Commission, ESG stands for Environmental, Social and Governance and is intended to make it easier to monitor and manage corporate performance and its social impact.

ESG criteria are increasingly relevant for the property sector, as they assess the sustainability of construction and renovation projects and require transparent reporting on environmental and social impacts. A study by Deloitte also shows that property companies that integrate ESG criteria into their business practices not only fulfil legal requirements, but can also strengthen their market reputation and potentially achieve higher returns (source: Deloitte, 2022).

As of today, not all real estate companies in the EU have to comply with the ESG criteria catalogue. However, capital market-oriented companies and non-capital market-oriented companies that fulfil two of the following three criteria are affected:

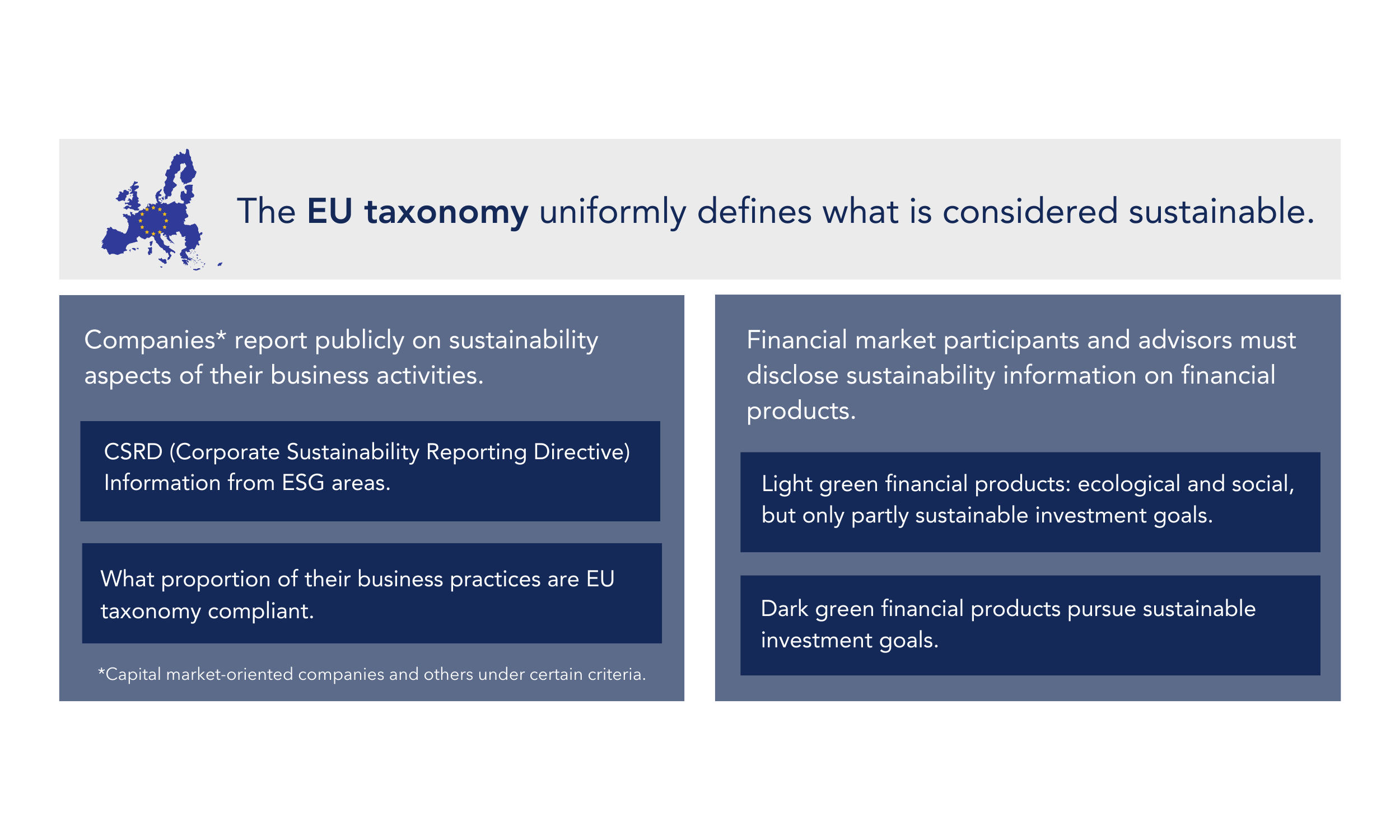

The EU’s ESG legal framework comprises various regulations and directives that together promote sustainable development and transparency:

Together, these regulations and directives form the foundation of the ESG legal framework in the EU. They help to ensure that companies and investors integrate sustainable practices into their business strategies and ensure transparent reporting. Compliance with these regulations is crucial to remaining competitive in the long term and maximising the value of investments.

European countries that are not part of the EU have now also taken stricter measures around the property sector. In Switzerland, for example, the “Energy Strategy 2050” has been introduced, which requires the property sector to reduce its CO2 emissions to 65 TWh by 2050 (source: BFE).

The EU taxonomy emphasises the importance of complying with ESG criteria. These are crucial not only to avoid fines, but also to make investments more attractive on the market and increase their value in the long term. Below we present some effective ESG investment strategies that enable the economic development of ESG projects.

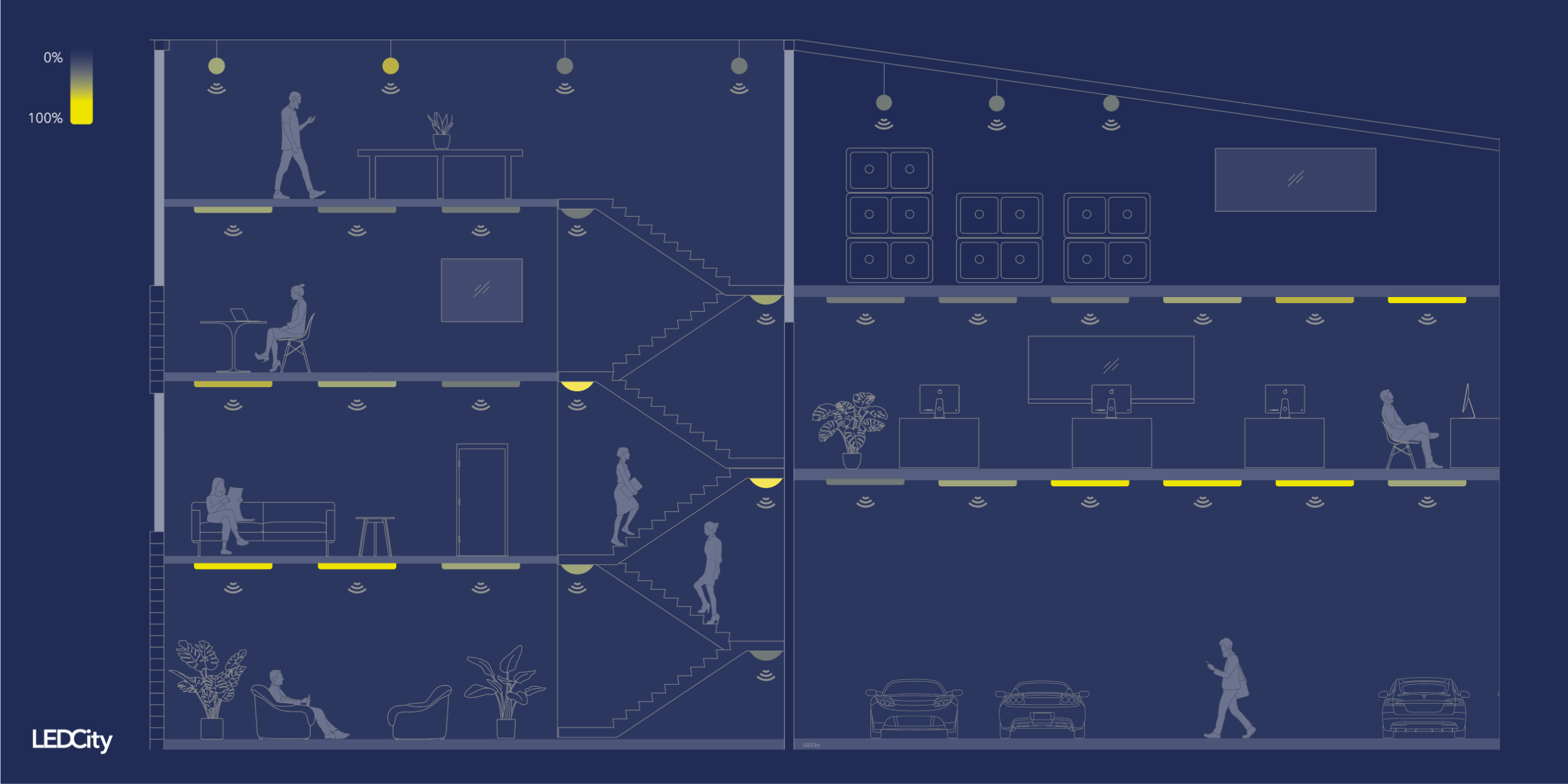

ESG investments not only assume environmental and social responsibility, but can also achieve long-term economic benefits. A prime example of this is the measure to improve energy efficiency. Reducing energy consumption leads directly to cost savings. For example, the existing lighting can be replaced with an intelligent LED lighting system, resulting in energy savings of up to 90 %. This investment is amortised in just 2-3 years thanks to the high savings and rising energy prices.

Another exciting aspect of this is ESG sustainability reporting. Modern, IoT-based lighting systems enable the collection of important data, such as actual energy savings and optimisation opportunities in other areas, such as heating. You can read more about data in buildings in this blog.

A successful example of this is the redevelopment of the ZHil neighbourhood near Manegg in Zurich by Mobimo, a Swiss property owner. The project report shows how Mobimo AG has achieved a balance between cost-effectiveness and sustainability. Find out more about the ZHil Manegg project.

Even if not all companies in the EU are currently obliged to fulfil ESG criteria, it still makes sense to invest sustainably now. The number of companies affected has increased significantly in recent years and it is foreseeable that the EU ESG regulations will affect more companies in the future. In addition, it is already clear today that investments in sustainable practices can significantly increase the value of property portfolios. Investments in the energy efficiency of buildings are particularly noteworthy, as they lead to both significant cost savings and a higher market value. Arrange a free, 15-minute consultation to find out how you can comprehensively prepare your building portfolio for the future: